Institutional Insights: Credit Agricole FX Weekly 21/11/25

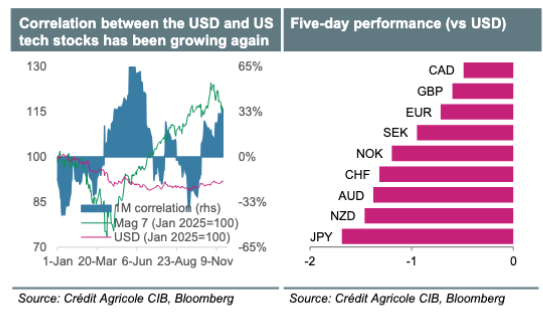

The economic strength of the US amid the Trump administration's trade, fiscal, and immigration policies in 2025 has taken many by surprise. A significant factor contributing to this resilience is the ongoing boom in AI investments, which: (1) supports the US economic outlook; (2) drives the post-“Liberation Day” equity market rally and increases the wealth of US consumers; and (3) mitigates concerns regarding the adverse effects of Trump’s immigration policies on US potential growth. Furthermore, US technology stocks have seen a rise in unhedged foreign portfolio investments, which has helped the USD recover, as demonstrated by the positive correlation observed between the two since October.

Recently, however, markets have begun to reevaluate the macroeconomic implications of AI and the valuation of technology stocks. Some foreign exchange investors have expressed worries that although AI may enhance long-term economic productivity, it could negatively impact labor demand and suppress inflation in the short term, thus necessitating a somewhat more dovish perspective on the Fed. Such anxieties could put pressure on US technology stocks and the USD itself, diminishing the support for the currency from traditional ‘USD-smile’ factors like its relative interest rate attractiveness and safe-haven status.

In the short term, the USD may continue to serve as a high-yielding safe haven in the G10. Its strengthening correlation with US stocks makes it susceptible to any potential decline in technology stock performance. In addition to US equity performance, attention will be directed towards the most recent US economic data releases, which are gradually coming out following the reopening of the government, along with Fed communications. The USD's recovery might lose momentum amidst possible data disappointments and more dovish signals from the Fed.

Looking ahead to next week, investors in GBP will closely analyze the autumn statement in an effort to gauge its effects on UK growth and the Bank of England's policy outlook. Many negative factors are already priced in, and the GBP might stabilize in the absence of growth-negative surprises from the budget. Meanwhile, EUR investors will concentrate on the latest ifo data from Germany and statements from ECB officials. The Reserve Bank of New Zealand is expected to reduce its Official Cash Rate by 25 basis points to 2.25% next week but will likely be cautious about indicating any further significant rate cuts in its Monetary Policy Statement due to inflation aligning with the upper range of its target band.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!