The FTSE Finish Line 24/9/25

London stocks started Wednesday on a subdued note as investors absorbed an overnight sell-off on Wall Street following comments from Federal Reserve Chair Jerome Powell and evaluated corporate updates closer to home. Heading into the close, however, sentiment had stabilised, with the FTSE gaining momentum thanks to a sterling selloff, ultimately finishing the session in positive territory. Wall Street's major indexes had slipped overnight after Powell highlighted the need for the central bank to balance the dual challenges of persistent inflation and a weakening job market in upcoming interest rate decisions, while offering limited clarity on future rate directions. Despite this uncertainty, investors remain optimistic that the U.S. Federal Reserve will implement rate cuts during its final two meetings of the year.

Jaguar Land Rover, Britain's largest carmaker, will keep its factories closed until October 1 due to a cyberattack earlier this month. The shutdown affects operations, smaller suppliers, and 33,000 staff, with production losses estimated in the tens of millions. JLR's British supply chain, supporting over 100,000 jobs, faces potential disruption. The Unite Trade Union has warned of job losses and urged government support, while officials are working with JLR to assess the impact.

Shares of Saga PLC increased by 8.3% to 235p, marking the highest level since May 2022 and making it the top performer on the FTSE SmallCap index. The company reported a 7% year-over-year increase in H1 underlying revenue, totaling 320.5 million pounds ($432.3 million), while trading EBITDA rose by 8% to 67.5 million pounds. The company stated, "In Travel, we have strong forward bookings for the second half of the year." They remain on track to meet FY underlying profit before tax, despite facing higher finance costs. With the latest gains, the stock has surged approximately 93% year-to-date.

Shares of North Sea-focused oil producer EnQuest fell 3.1% to 11.4 pence. The company reported a loss after tax of $173.5 million for the first half of the year, compared to a profit of $30.3 million in the same period last year. Nevertheless, analysts from Peel Hunt and J.P. Morgan remain optimistic about the company's performance in the first half, noting its strong operations. The company maintains its annual production guidance of 40,000 to 45,000 barrels of oil equivalent daily. As of the last closing, the stock has decreased by 6.5% year-to-date.

Pinewood Technologies has fallen by 10.7%, now at 472.5p, making it one of the biggest percentage losers on the FTSE mid-cap index, which has decreased by 0.13%. The British auto retailer anticipates an EBITDA of £15.5 million to £16 million ($20.9 million to $21.6 million) for 2025, compared to analysts' expectations of £18.4 million, according to Berenberg. Jefferies and Berenberg noted that delays in the execution and deployment of the Marshall contract, along with a £1.3 million accounting setback, have led to a downward revision of the EBITDA forecast. Nonetheless, both firms point out the company's "ambitious" targets for 2028, emphasising the potential for growth. Year-to-date, PINE has increased by 33%.

Shares of the British financial services firm International Personal Finance rose by 8.04% to 215 pence, marking the highest level since January 2019. The stock has become the second largest gainer on the FTSE small-cap index. The company has received an improved takeover proposal of 235 pence per share from the US-based BasePoint Capital, an increase from the previous bid of 223.8 pence. This new offer values IPF at approximately 514.9 million pounds ($693.21 million). The board of IPF has unanimously endorsed the deal for its shareholders. Including gains from this session, IPF's stock has risen around 63% year-to-date.

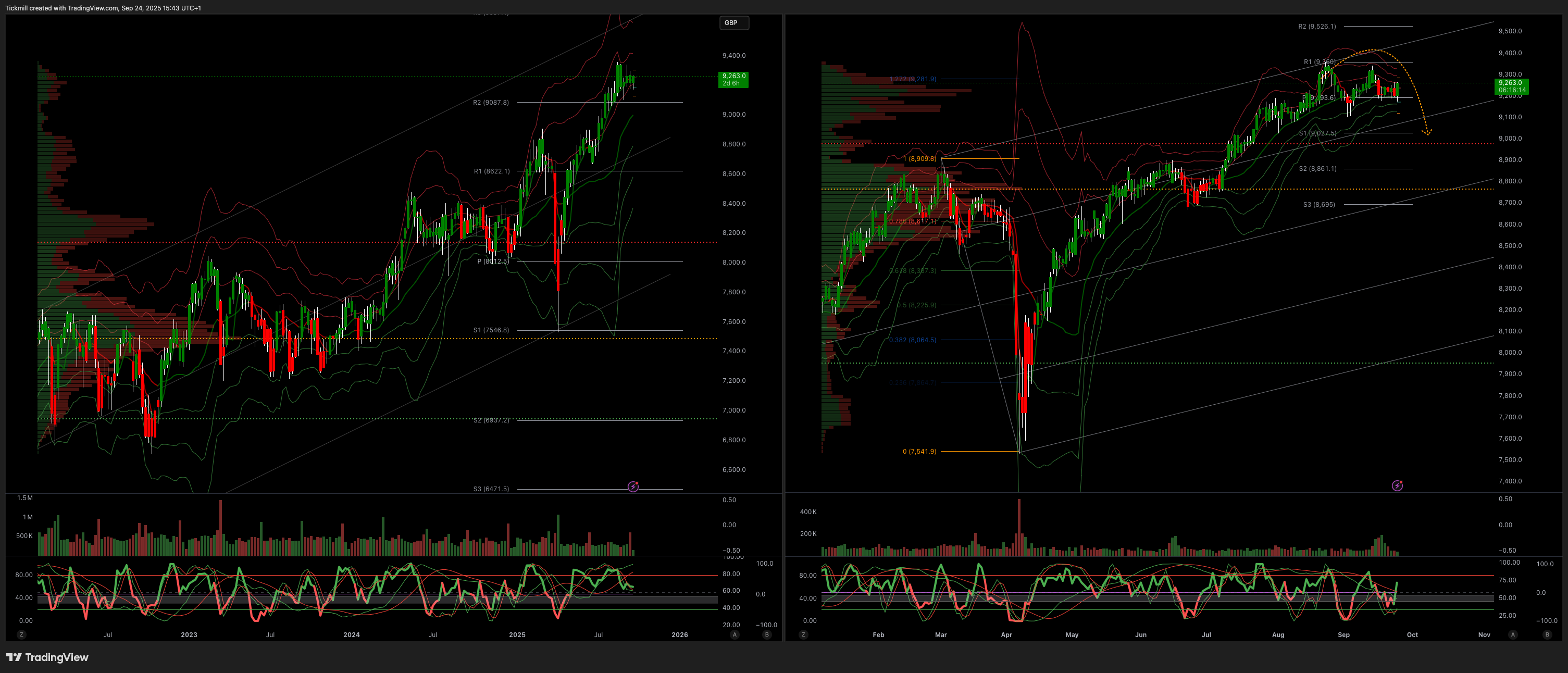

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 9000

Below 8900 opens 8600

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!